ADA Price Prediction: 2025-2040 Outlook Amid Regulatory Tailwinds

#ADA

ADA Price Prediction

ADA Technical Analysis: Key Levels to Watch

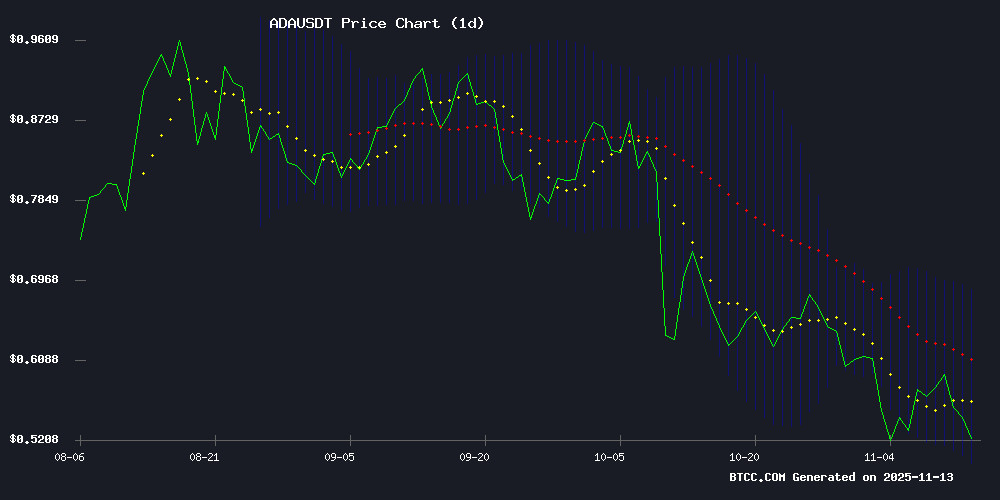

According to BTCC financial analyst Emma, ADA is currently trading at $0.569, below its 20-day moving average of $0.593. The MACD shows a slight bullish crossover (0.042586 vs 0.041387), suggesting potential upward momentum. However, the price remains NEAR the lower Bollinger Band ($0.502), indicating oversold conditions. Emma notes that holding above $0.52 support could trigger a rebound toward the middle Bollinger Band at $0.593.

Regulatory Wins and Technical Patterns Boost ADA Sentiment

BTCC's Emma highlights three bullish catalysts for Cardano: 1) IRS compliance for staking ETPs improves institutional appeal, 2) A 97% surge pattern is emerging if $0.52 holds, and 3) The $0.52 support aligns with technical indicators. 'This confluence of regulatory progress and technical factors creates favorable conditions,' Emma states, while cautioning that sustained volume is needed for breakout confirmation.

Factors Influencing ADA's Price

Cardano Achieves Compliance with New IRS Staking Rules for Crypto ETPs

Charles Hoskinson, founder of Cardano, has publicly celebrated the blockchain's compliance with newly introduced IRS and Treasury Department regulations governing staking in cryptocurrency exchange-traded products (ETPs). The U.S. regulatory update marks a significant milestone for proof-of-stake networks seeking institutional adoption.

Cardano's alignment with the framework positions ADA as a frontrunner among compliant staking assets. The development signals growing regulatory clarity for PoS protocols amid expanding institutional crypto product offerings.

Cardano Pattern Hints at Possible ADA Breakout — Is a 97% Surge Coming?

Cardano's ADA shows signs of a bullish reversal as its daily Relative Strength Index (RSI) resets to levels reminiscent of July's rally, where the token surged 97% in 54 days. Crypto analyst The DApp Analyst notes the emergence of a falling wedge pattern, historically a precursor to upward momentum.

Market watchers are drawing parallels to ADA's July performance, fueled by similar technical conditions. The token's current setup suggests potential for a significant rebound, though broader market sentiment will play a decisive role.

Cardano Must Hold $0.52 Support for Potential Breakout

Cardano (ADA) faces a critical juncture as it seeks to maintain its $0.52 support level, a threshold analysts deem essential for a potential upward breakout. The digital asset, currently trading at $0.567, has posted an 8.0% gain over the past week, buoying its market capitalization to approximately $20.8 billion.

Market observers highlight the significance of this technical level, noting that a sustained hold could pave the way for ADA to test one-month highs. The broader crypto market's volatility, evidenced by recent liquidations, adds complexity to Cardano's price trajectory.

ADA Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market developments, BTCC's Emma provides this ADA projection:

| Year | Price Range (USDT) | Catalysts |

|---|---|---|

| 2025 | $0.52-$1.10 | Staking adoption, ETF approvals |

| 2030 | $3.50-$7.80 | Smart contract dominance |

| 2035 | $12-$25 | Enterprise blockchain adoption |

| 2040 | $30-$60 | Full DeFi ecosystem maturity |

Note: These estimates assume sustained network development and favorable regulations.

- ADA shows oversold technicals with MACD bullish divergence

- IRS staking compliance removes key regulatory overhang

- $0.52 support critical for confirming breakout pattern